Transport

Apr 25 2024

Birmingham Airport (BHX) has achieved Level 3 (optimisation) of the Airport Carbon Accreditation (ACA) scheme for a second year.

Read more

A new Midlands Engine Insights report finds that the scale and economic contribution of the region’s aerospace cluster is considerably greater than current statistics used by policy makers.

The report, co-authored by Midlands Engine Observatory (MEO) and Midlands Aerospace Alliance (MAA), also finds that the cluster needs to be much better understood to establish where R&D funding should be most effectively allocated.

Official statistics suggest the Midlands has around 20,000 aerospace jobs across 225 sites. Policy makers know this data, based on Standard Industrial Classification codes, is often very inaccurate because of the way companies are categorised, but there is usually little better information.

Using a comprehensive company dataset collected from the bottom-up – an approach that’s believed to be the first of its kind in the UK – the MAA and MEO have calculated that these numbers are, in fact, much higher with:

The Midlands’ aerospace supply chain in a national context, therefore, covers over 20% of UK aerospace sites – up from 10% as previous data would indicate.

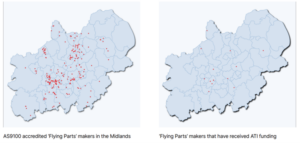

The Midlands is home to 21% of the most specialist UK aerospace companies, those with the demanding “AS9100” accreditation that permits them to make ‘flying parts’ of aircraft.

Further analysis suggests that the most technically specialist Midlands aerospace companies generate over £3.5bn Gross Value Added (GVA) for the Midlands economy.

After adding in regional economic multiplier effects generated by company and employee spend, over 100,000 Midlands jobs and £5.3bn GVA are created by the revenue brought into the region by Midlands business success in global aerospace markets.

The Midlands is home to 21% of the most specialist UK aerospace companies, those with the demanding “AS9100” accreditation that permits them to make ‘flying parts’ of aircraft.

The report also analysed how much R&D funding was invested by government. It found that:

While this suggests Midlands aerospace has benefited greatly from national R&D grants, the funding is highly concentrated in large companies and universities. Aero-engine maker Rolls-Royce is the main recipient, receiving 75% of all grants, and 91% of all grants awarded to industry.

The report’s new dataset, in contrast, finds that:

The report asks whether this skewed distribution may suggest a level of untapped innovation potential in the regional aerospace cluster.

94% of AS9100-accredited ‘flying parts’ companies have not been awarded any R&D grants directly from the ATI or other parts of the national aerospace R&D ecosystem.

It will be important to understand:

The MAA and MEO are now using the comprehensive data and findings from this project as a foundation for wider research and projects.

Transport

Apr 25 2024

Birmingham Airport (BHX) has achieved Level 3 (optimisation) of the Airport Carbon Accreditation (ACA) scheme for a second year.

Read more

Global

Apr 24 2024

World-leading materials science and technology consultancy Lucideon is targeting international growth with expansion in the Japanese market.

Read more

Global

Apr 18 2024

The Midlands Engine Partnership will host a Pavilion for the very first time at this year’s UK Real Estate Infrastructure Investment Forum [21-23 May], providing regional partners with a platform to showcase their investment propositions, worth in excess of £42bn, to a global audience.

Read more